The Complete Finance Manager Course 2021 by 365 Careers

Salepage : The Complete Finance Manager Course 2021 by 365 Careers

Archive : The Complete Finance Manager Course 2021 by 365 Careers

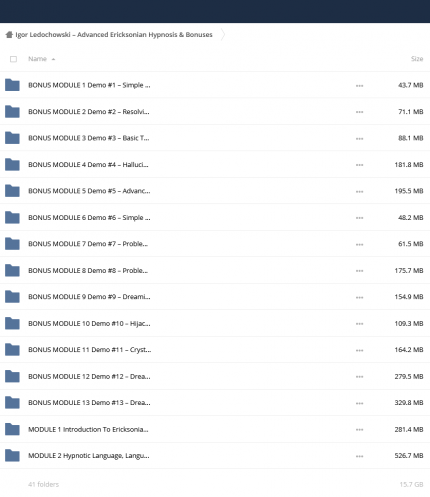

FileSize :

Understand how companies measure financial performance

Determine why ERP systems facilitate business process

Employ best practices when working on the implementation of an ERP system

Learn basic accounting principles

Specialize in advanced accounting topics (revenue recognition, invoicing mechanics, cost flow methods, capitalized costs, fair value accounting, revaluation, etc.)

Secure financing and understand debt covenants

Perform leasing calculations

Perform pension liabilities calculations

Know how to optimize a company’s working capital

Perform inventory, trade receivables, and trade payables management

Recognize when a company is inefficient in its working capital management

Understand the time value of money

Be able to calculate cost of debt, cost of equity, and WACC

Forecast future cash flows

Discount future cash flows to obtain their present value

Know how to raise equity

Understand the treatment of dividend payments, share repurchases, and stock splits

Perform financial statement analysis

Assess investment opportunities

Apply capital budgeting techniques such as: NPV, IRR, and ROI

Build capital budgeting financial models from scratch

Perform sensitivity analysis

Create interactive Excel dashboards

Use Excel slicers for financial reporting

Create professional and attractive corporate presentations – in line with ones prepared by top tier investment banks

Study the ten key principles of presentation creation

Learn how to create company profile, key financials, share price, group structure, waterfall, geographical presence, and other types of slides used in finance

Calculate a company’s net cash flow

Be able to create a company valuation model from scratch

Calculate a firm’s enterprise and equity value using DCF

Learn how to become an effective and respected manager

Be able to recruit, select, onboard, train, develop, and retain talented employees

Provide employee feedback

Organize performance review meetings

Negotiate effectively

Apply negotiation tactics that will ensure your success in the long run

What is Business ?

Business is the activity of making one’s living or making money by producing or buying and selling products (such as goods and services).[need quotation to verify] Simply put, it is “any activity or enterprise entered into for profit.”

Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business. If the business acquires debts, the creditors can go after the owner’s personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business.

The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company. A company, on the other hand, is a separate legal entity and provides for limited liability, as well as corporate tax rates. A company structure is more complicated and expensive to set up, but offers more protection and benefits for the owner.

The Complete Finance Manager Course 2021 by 365 Careers

Readmore About : The Complete Finance Manager Course 2021 by 365 Careers