Price Ladder Training(copy)

Salepage : Price Ladder Training(copy)

Archive : Price Ladder Training(copy)

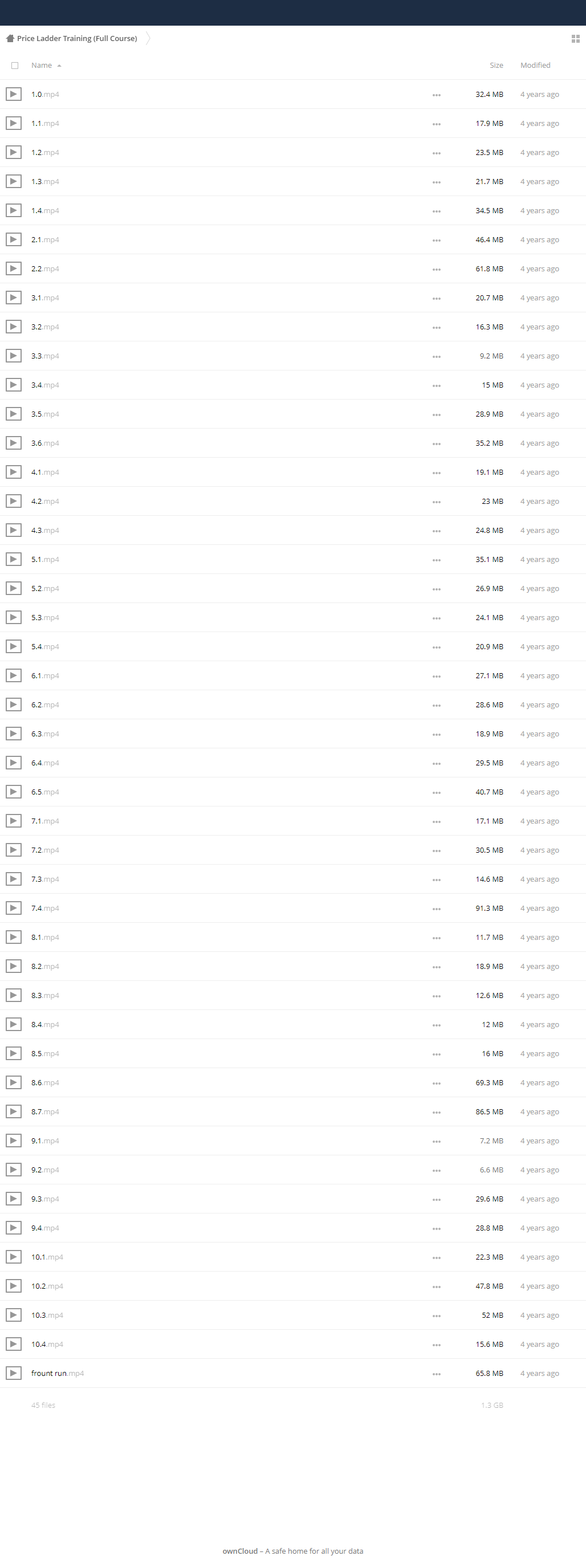

FileSize : 1.3 GB

Description

The Price Ladder Training programme was developed with a vision in mind. That vision was to cause a paradigm shift in trader development, by providing a platform for traders of all experience levels to rapidly hone the invaluable skillset of reading order-flow in the financial markets. By training them how to read order-flow, our ultimate objective is to create the next generation of great traders.

With our intensive simulated Trading Drills, the programme utilizes our proprietary FutexLive Replay technology to rapidly accelerate your understanding of how to trade order-flow patterns, using institutional Level II trading software commonly known as the “Price Ladder”. The Price Ladder is our traders’ number one execution platform and is the most effective way to profit from major event-driven risks and specific order flow patterns, which are Futex’ most profitable setups.

The programme has been created so that it exposes you to the fundamental elements of the market; buyers and sellers. It is geared towards accelerating your learning curve in the art of basic of order-flow and also the science behind trading the most volatile risk events, in order to profit from them as our professional traders do. All of our traders undergo the intensive Price Ladder Training, which ultimately gives them a much greater chance of reaching a consistently profitable performance.

PROVIDE THE BACKGROUND KNOWLEDGE AND CONTEXT BEHIND THE SETUP. We make sure you have a solid understanding behind the premise of the order flow pattern or setup.

REHEARSE SKILLS IN REALISTIC COMBINATIONS. We do not simply want you to learn to place orders in the book, but we drill you on placing orders based upon what you see on the Price Ladder. We give you drills in different market environments i.e. rangebound, trending, high/low volatility, high/low volume.

SET GOALS FOR EACH PRACTICE SESSION TO GENERATE IMMEDIATE FEEDBACK. Each practice session’s objectives is based upon progress from previous sessions. Goals are specific, so you can track gains in your learning.

DRILL SKILLS TO PROMOTE IMPLICIT LEARNING. We want to make skills automatic through rapid repetition, solidifying learning, and providing resistance to emotional interference.

With this specific structure we have the ability and intention to push your learning curve to its limits.

What is forex trading?

Forex, or foreign exchange, can be explained as a network of buyers and sellers, who transfer currency between each other at an agreed price. It is the means by which individuals, companies and central banks convert one currency into another – if you have ever travelled abroad, then it is likely you have made a forex transaction.

While a lot of foreign exchange is done for practical purposes, the vast majority of currency conversion is undertaken with the aim of earning a profit. The amount of currency converted every day can make price movements of some currencies extremely volatile. It is this volatility that can make forex so attractive to traders: bringing about a greater chance of high profits, while also increasing the risk.

How do currency markets work?

Unlike shares or commodities, forex trading does not take place on exchanges but directly between two parties, in an over-the-counter (OTC) market. The forex market is run by a global network of banks, spread across four major forex trading centres in different time zones: London, New York, Sydney and Tokyo. Because there is no central location, you can trade forex 24 hours a day.

There are three different types of forex market:

- Spot forex market: the physical exchange of a currency pair, which takes place at the exact point the trade is settled – ie ‘on the spot’ – or within a short period of time

- Forward forex market: a contract is agreed to buy or sell a set amount of a currency at a specified price, to be settled at a set date in the future or within a range of future dates

- Future forex market: a contract is agreed to buy or sell a set amount of a given currency at a set price and date in the future. Unlike forwards, a futures contract is legally binding

Most traders speculating on forex prices will not plan to take delivery of the currency itself; instead they make exchange rate predictions to take advantage of price movements in the market.

Curiculum

![Actioncoach.Kajab - Brad Sugars Profit Masters [Billionaire in Training] download](https://ivseed.info/wp-content/uploads/2022/03/zz.jpg)

Reviews

There are no reviews yet.